Welcome to the Daily Dish. Every morning in your inbox subscribers receive some Dishes that we find interesting and we think that you should know more about.

We’ll try to lob ‘em up to you in a simple, clean format that you can read in 5 minutes before the market opens. (Trust me, we know what it’s like to wake up at 9:23am).

Here’s the first assist 👇

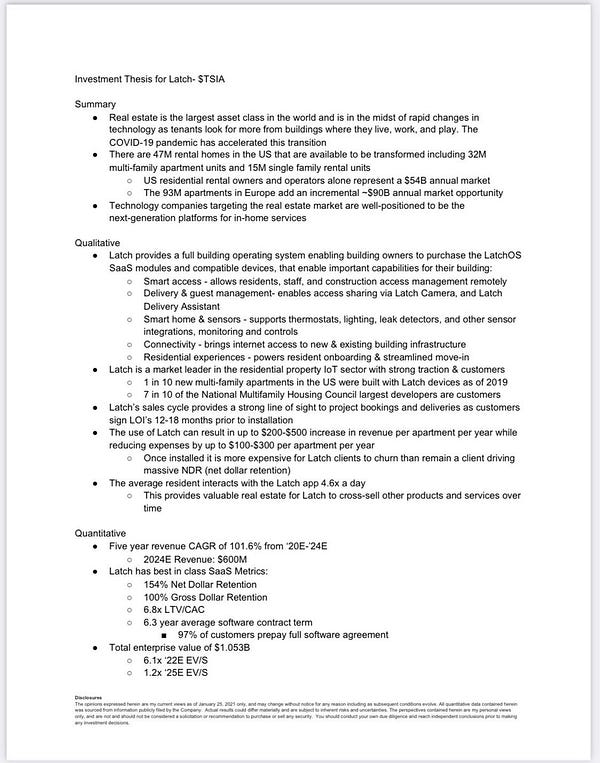

Smart-Lock Maker Latch to Use Tishman Speyer SPAC to Go Public

Latch Inc., a maker of smart locks and building-management software, plans to go public by merging with a special-purpose acquisition company backed by a real-estate giant, the latest startup looking to use a so-called blank-check vehicle to cash in on strong investor interest in tech-enabled businesses.

The merger will unite venture-capital-backed Latch with TS Innovation Acquisitions Corp., $TSIA a special-purpose acquisition company sponsored by New York commercial real-estate firm Tishman Speyer Properties LP that raised $300 million late last year, the companies said Monday.

Latch was founded in 2014 and provides buildings and residents with services such as smart access, smart home sensors and connectivity. The company has worked with large real estate owners and investors, including Tishman Speyer and has booked over 300,000 units across more than 35 states. In 2019, one in ten new multifamily apartments in the U.S. were built with Latch software.

A $190 million PIPE is being led by investors including BlackRock and SPAC King Chamath Palihapitiya.

The SPAC deal values Latch at an enterprise value of $1.56 billion and the company will get $510 million in proceeds from the deal. Latch is expected to trade on the Nasdaq under the symbol $LTCH, they said.

Sunlight and Apollo-Affiliated Spartan Acquisition Corp. II Enter Into Business Combination Agreement

Sunlight is a B2B2C fintech platform that provides residential solar contractors with seamless point-of-sale (“POS”) financing capabilities and delivers unique, attractive assets to capital providers. Through its proprietary technology and deep contractor network, Sunlight offers instant credit decisions and affordable solar loans to homeowners nationwide. Sunlight prides itself on creating value for all constituents it serves – solar contractors, capital providers, and consumers. $SPRQ

Residential solar is a multibillion-dollar market at the forefront of the fast-growing clean energy industry. To date, Sunlight has funded over $3.5 billion of loans through its proprietary platform. Sunlight’s best-in-class underwriting has delivered the industry’s strongest-performing residential solar loans to its funding partners. As a tech-enabled solar financing provider, Sunlight is committed to strong environmental, social and governance (“ESG”) principles. Sunlight has arranged financing for more than an estimated 100,000 residential solar systems, which will produce over 500 megawatts of solar-generated electricity and avoid more than 10 million metric tons of carbon dioxide emissions.

“Spartan and Apollo are committed to being ESG leaders. We are excited to team up with Sunlight to enable the energy transition by providing affordable, responsible financing for customers to own their residential solar systems,” said Geoffrey Strong, CEO of Spartan and Senior Partner, Co-head of Infrastructure and Natural Resources at Apollo. “Matt and the Sunlight team have built an outstanding, proprietary fintech platform to pursue that mission. The business has substantial operating leverage, which well prepares Sunlight to grow and profit for years to come.”

Taboola is going public via SPAC

subSPAC first told you about Taboola’s possible SPAC on December 28th - and now it’s official!

To achieve this, it will merge with ION Acquisition Corp, $IACA which went public in 2020 with the aim of funding an Israeli tech acquisition (Haaretz reported last month that Taboola was in talks with ION). The transaction is expected to close in the second quarter, and the combined company will trade on the New York Stock Exchange under the ticker symbol $TBLA.

Founded in 2007, Taboola powers content recommendation widgets (and advertising on those widgets) across 9,000 websites for publishers including CNBC, NBC News, Business Insider, The Independent and El Mundo. It says it reaches 516 million daily active users while working with more than 13,000 advertisers.

The deal will value Taboola at $2.6 billion. Through this transaction, the company plans to raise a total of $545 million, including $285 million in PIPE financing secured from Fidelity Management & Research Company, Baron Capital Group, funds and accounts managed by Hedosophia, the Federated Hermes Kaufmann Funds and others.

Singolda said that the company plans to invest $100 million in R&D this year, and that he hopes to expand the technology into areas like e-commerce and TV advertising, with the goal of moving “beyond the browser.” More broadly, he said he wants Taboola to be be “a strong public company that champions the open web.”

Here’s the last assist 👇

If you enjoyed today's dish please gift it to a friend (or Harden) 👇

There’s No I In Trade

My goal is to create a community where people can educate themselves through the world of investing. I can’t do that alone, we need to build this community together. So tell me what you’re loving, tell me what you want to see more of tomorrow.