Friends,

Most weeks in this article I will recap Special-Purpose Acquisition Companies that we’ve covered in our Daily Dishes. Today being our first edition - I thought I’d do something different. 🤷♂️

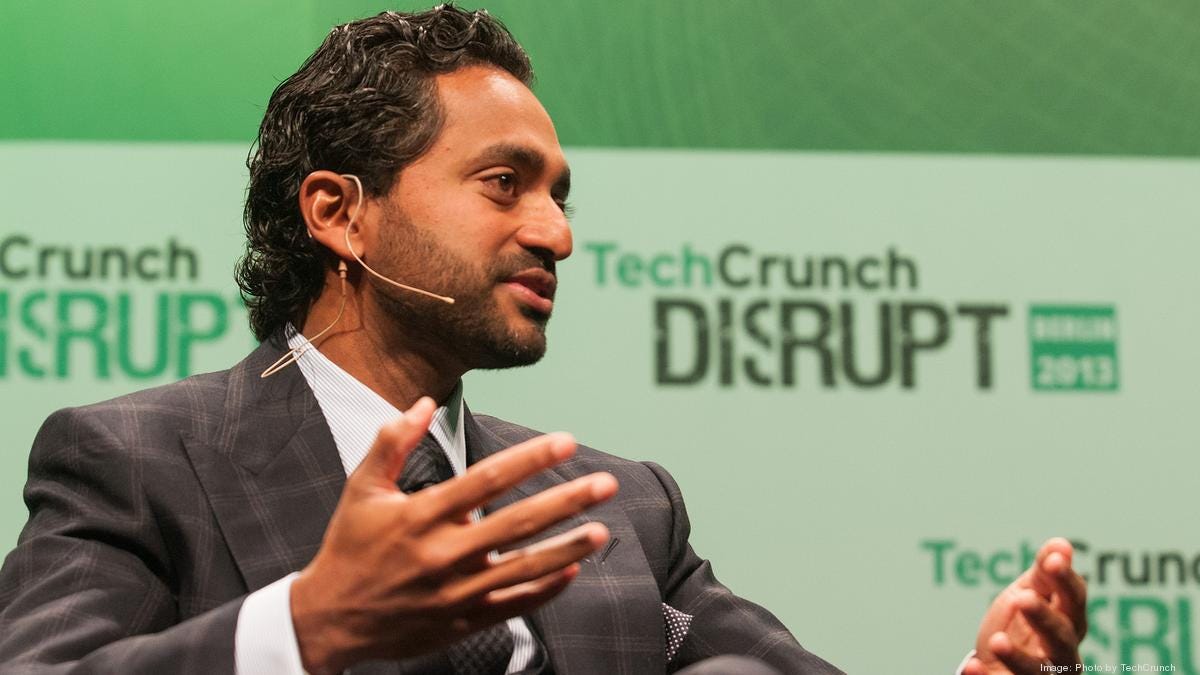

I’ll be breaking down Chamath, Chamath, and Chamath. I mean the King of SPACs deserves to be the first breakdown on this newsletter right? What’s up with $IPOA-Z, Social+Capital, and why are they so prevalent in the world of SPAC?

Let’s find out. 👇

Okay… so who is Chamath?

Palihapitiya, a Sri Lankan-Canadian-American immigrant, did not start his career flipping companies - he quite literally started off flipping Whoppers at Burger King. Through a combination of smarts, grit, and a knack for growth, he found himself at AOL working on Instant Messenger, and by 2007 he was one of the earliest employees at Facebook. He became one of the five executives in charge and was responsible for growing the Zuck’s company from ~50 million users to almost 750 million.

What exactly is Social+Capital?

In 2011 Palihapitiya - after leaving Facebook with a mountain of cash - had the aim of using it to ultimately help humanity. But he wants to make a lot of fucking money doing it. He banded together Peter Thiel, co-founder of Paypal ($PYPL) and Palantir ($PLTR), Kevin Rose, co-founder of Digg, and a coterie of other VC titans to form Social+Capital.

“What sets him apart is his ambition to create a working model of what he calls “activist capitalism.” Unlike a Bill Gates or an Andrew Carnegie, who made their fortunes then devoted themselves to philanthropically spending them, Palihapitiya sees no reason to separate those two missions. He wants to continue to make millions, if not billions, through investments that serve high ideals.”

He made some prescient and timely bets - Slack, Tesla, Amazon, Bitcoin, (and the Golden State Warriors) to name a few.

To The Moon 🚀

In late 2017 Chamath devised a long, overarching plan for Social+Capital. He wants it to become the Berkshire Hathaway of the 2000’s (and by extension he wants to be the Oracle of Ottawa). His first big play? Teaming up with the UK’s most famous entrepreneur Richard Branson for a moon mission, bringing Virgin Galactic to the public markets. Social Capital Hedosophia $IPOA (now $SPCE) was born, and the great SPAC race started.

Seeing Double

Not even 6 months after the Galactic IPO in late 2019, Chamath announced the mysterious Double SPAC. $IPOB and $IPOC - Social Capital Hedosophia II and III. “Why two SPACs instead of one? Each SPAC is targeting a different-sized target. $IPOC is the larger entity; it raised over $700 million in its IPO and is targeting a tech "unicorn" with a valuation above $1 billion. $IPOB raised $360 million in its IPO and is, therefore, targeting a mid-sized company.”

$IPOB - Will merge with Opendoor, a real estate company, before the end of December 2020. It has sold over $10 billion worth of properties since its founding in 2014 and served more than 80,000 clients. The company is active in 21 markets, and its 2019 revenue came in at $4.7 billion.

$IPOC - Will merge with Clover Health. Their mission is to make healthcare more accessible and affordable for all, and it's started by creating a Medicare Advantage insurance program that's far less costly than both original Medicare and its competitors' Medicare Advantage offerings. Using machine learning, Clover is able to surface various conditions to increase the quality of care and reduce the cost. Management believes it can overlay data to increase its margins and build a competitive advantage.

Their current merger Vote date is scheduled to happen in January 2021.

SPAC The Whole Damn Alphabet

You can't spell SPAC without Social Capital's Chamath Palihapitiya. Leaving no doubts about his future plan, Palihapitiya said on a recent podcast that he has reserved ticker symbols for rest of the SPAC alphabet, too, from "IPOG" to “IPOO” to"IPOZ."

Explaining on TV why SPACs have been multiplying rapidly this year, Palihapitiya said, "The reality is that a lot of investors are really shut out from the growth that exists in Silicon Valley tech businesses. What I'm trying to do is really democratize that access."

If you enjoyed today’s email, subscribe now to receive future emails directly in your inbox.

Homework

If you’re interested in learning more about the Chamath Palihapitiya and the history of early Facebook, there’s a great book called Facebook: The Inside Story. I highly recommend it.

Chamath has also wet his beak with other SPACs. He was a financier for the Trine Acquisition Corp - a SPAC that is taking Desktop Metal ($DM) public. Palihapitiya was also a financer for Fortress Value Acquisition Corp, which is merging with MP Materials ($MP), a rare earth metal company trying to solve climate change. His latest is Insu Acquisition Corp II ($INAQ), a SPAC merging with David Friedberg’s Metromile - insurance-focused fintech powered by data science and machine learning aiming to reduce the average consumer’s cost of insurance.

A collection of some of his Investment Thesis’ for his SPACs - Highly Recommended

My Watch List for the week of December 13th, 2020

The Daily Dish - Some SPACs I will be watching closely for movement👀

$IPOB (Opendoor) - Merger vote on 12/17. Did I mention ARK’s Cathie Wood has been buying this stock up before the merger?

$QELL (Qell Acquisition Corp) - Something’s brewing (Speculation of a Proterra merger). Common shares spiked from $11 to above $13 on no QELL news. Risky.

$LCA (Golden Nugget)- Tillman’s SPAC has a merger meeting on 12/18.

$OPES (BurgerFi)- Another merger meeting 12/15. Go get a burger - they’re good.

$BFT (Paysafe) - Bill Foley. SPAC. Need I say more?

If you want to see future Daily Dishes subscribe now to receive daily emails directly in your inbox. Lucky you - reading down this far on the page gets you 20% off annual plans forever.

There’s No I In Trade

My goal is to create a community where people can educate themselves through the world of investing. I can’t do that alone, we need to build this community together. So tell me what you’re loving, tell me what you want to see more of next week. And most importantly, when your buddy asks how you know so much about the Oracle of Ottawa, tell em’ about us.