Will PropertyGuru Face the Same Fate as Zillow

The Rundown - Your weekly SPAC Deep Dive (11/24/21)

Hello Friends and Happy Thanksgiving! 🦃

What a wild, volatile ride the SPAC markets are.

Thanks for being a subscriber to subspac. Hopefully this has helped you understand what is currently transpiring across assets and markets.

I really enjoy writing about SPACs, finance, macroeconomics, and cryptocurrencies every morning for 30,000 investors.

During uncertain times, I am a big believer that knowledge is power and the best investment you can make is an investment in yourself. Because of that, I’m bringing back the Black Friday Sale from last year.

Happy Holidays,

Bill

Transforming Southeast Asian Real Estate

Over a Decade and a Half Ago, Steve Melhuish and Jani Rautianen struggled to search for homes in Singapore and found the whole process rather laborious. After finding the experience time-consuming and lacking transparency, they decided to form PropertyGuru to make the process easier. Fifteen years later, PropertyGuru is now the leading property technology platform in Southeast Asia. The company now serves 37 million buyers across 16 countries and works with 50,000 partner agents across its network.

PropertyGuru is set to go public over the next few months through a SPAC merger with Bridgetown 2 Holdings, in a deal that values the firm at $1.78 billion. PropertyGuru is often called the Zillow of Southeast Asia as it largely mirrored the footsteps of the company (A Real Estate Marketplace which has grown through strategic M&A). But with Zillow recently struggling with its business and the real estate market cooling off in the US, will PropertyGuru face the same fate as Zillow?

Will PropertyGuru Face the Same Problems as Zillow?

Zillow recently announced that it would abandon its iBuying business and attempt to offload 7,000 unsold homes that it has currently invested in. From a logical perspective, Zillow entering the iBuying market space in 2018 made sense, because it increased the Total Addressable Market from a mere $18.8 Billion to a staggering $1.9 Trillion. But with the iBuying space still in its infancy in the US (less than 1% market penetration), requiring a huge capital outlay, and being highly sensitive to macro factors (demand, interest rates), it was evident that Zillow couldn’t crack the market in its relatively short stay.

Since the company announced that it would exit the space, Zillow stock has since lost 50% of its value and concerns about the real estate sector translating to other stocks. Opendoor is also down 30% since the announcement, as shareholders question the long-term viability the market if rates rise next year.

While some of this is down to iBuying itself, other macroeconomic factors have investors concerned about housing prices. With the Federal Reserve expected to taper $40 billion in housing bond purchases by June and raise the historically low-interest rates, people looking to flip homes could be in for a rude awakening in the fall next year.

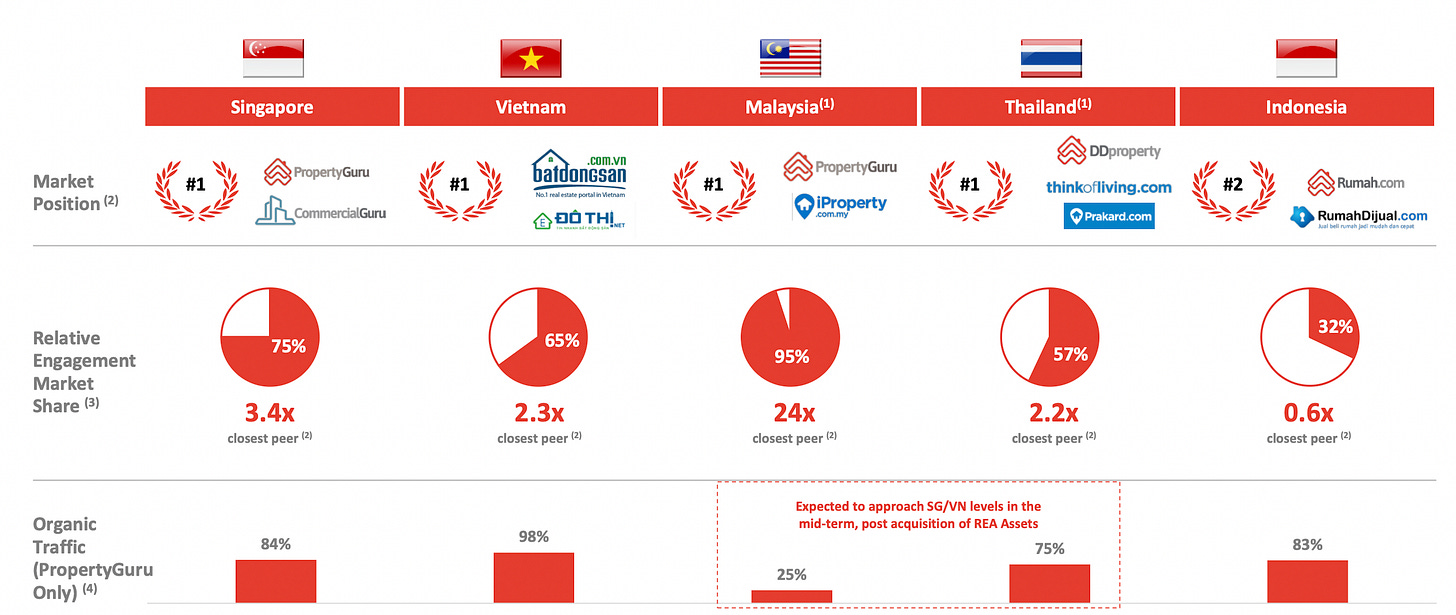

While US firms may struggle due to these factors, PropertyGuru operates in a very different landscape (both in terms of technology and regulation) compared to both Zillow and Opendoor. PropertyGuru is a market leader in four of the five largest economies in Southeast Asia, including Singapore, Vietnam, Malaysia, and Thailand with little to no advertising spend (organic traffic accounts for 73% of revenues). The expansion of the middle class, the massive inflow of foreign investment, and the acceleration of technological development should act as huge tailwinds over the next decade for the company.

PropertyGuru has focused on growing its marketplace & technology business and stayed away from iBuying (primarily as there is very little interest from consumers), which has resulted in a smaller TAM (which the company estimates are around $8.1 billion), but lower risk and higher margins.

The company primarily operates in three main segments, which include its flagship marketplace that connects home buyers and sellers, digital marketing services for agents and property developers, and financing solutions for consumers through partner banks. While the company currently relies on its marketplace business as a primary driver of revenue, management has been broadening its focus on digital products & services and fintech offerings in recent quarters to diversify its operations.

A Digital Marketplace Revolution

PropertyGuru began as a marketplace where users could buy and sell houses through agents. The platform caters to real estate agents through a subscription model, with different plans depending on the needs and size of the organization. In addition to facilitating transactions, the company also provides advertising and analytical tools to maximize both the reach and conversion for prospective clients. While most real-estate marketplaces focus on the residential market, PropertyGuru also targets commercial properties, offices, and warehouses (which should see a pickup in demand once people return to the office).

For developers, the platform offers digital advertising solutions to enhance reach. FastKey is a suite of products that helps developers automate the full project sales cycle from project laying to sale, contact agents on PropertyGuru to list the market, and a tool called StoryTeller, which allows developers to show a 3D model of the property, reducing the need for physical spaces.

PropertyGuru also operates a mortgage marketplace called PropertyGuru finance, where the company partners with major banks to finance transactions initiated on the marketplace (the company processed over $745 million in loans in the last 12 months). CEO Hari Krishnan has stated that ancillary services like mortgage and home insurance broking and data analysis will play a large part in the growth in the future.

PropertyGuru is also looking to strengthen its operations through strategic M&A investments. The company has made a string of acquisitions since 2015 which include technology startup FastKey (formerly known as ePropertyTrack), Indonesian Marketplace RumahDijual, Marketing Platforms Asia Property Awards, Vietnamese property portal Batdongsan, Data analytics Platform MyPropertyData and the acquisition of iProperty from REA group.

Inorganic revenue nearly accounted for half of the company’s operations in 2020 and may expand further, because the company has announced intentions to acquire an additional two to four potential targets with the war chest accumulated from the merger.

Financials and Valuation

PropertyGuru saw revenues falter in 2020 as transaction sharply fell, resulting in a top line of $61.9 million vs. 66.6 million in the prior year. Looking ahead, management has already seen a strong recovery in the first few quarters (19% growth YoY) and expects to end the year at $75.7 million.

Over the long term, management is forecasting that revenues will grow at a CAGR of 31% to $222.6 million in 2025. Gross margins stood at 87.6% in 2020 and are expected to remain above 85% over the long term (similar to Zillow’s margins before it entered iBuying) while the Adjusted EBITDA (not accounting for HQ Costs, REA Acquisition and Listing Costs) is expected to increase to 33% as a result of higher leverage and economies of scale.

PropertyGuru will debut with a value of $1.78 billion when it completes its merger with Bridgetown 2 Holdings. This implies a Forward Price/Sales multiple of 23.5x (FY21), which is abnormally high compared to publicly traded peers like Zillow (2.64x) and Opendoor (1.39x), despite the massive opportunities that currently exist across Southeast Asia. Given that there is very little room for error in the valuation, a slight shift in demand (due to rising rates) could lead to a massive selloff in the stock.

Bottom Line

PropertyGuru is a fundamentally sound business, with great unit economics and has substantial market share across major Southeast Asian economies. Despite being referred to as the Zillow of Southeast Asia, the company has managed to avoid the pitfalls of the US firm, while also strengthening its core operations by building out ancillary services (technology and finance). Furthermore, there is a significant growth runway, both organically as technological penetration improves across Southeast Asia and through strategic acquisitions, where the company has been so successful previously. The only concern from an investor's perspective would be about the valuation, which is a significant premium over its US peers at 23.5x forward revenues. The valuation will leave the stock vulnerable to a correction should housing/commercial demand subside even for a short period.