How is Talkspace is changing the behavioral health space?

The Rundown - Your weekly SPAC Deep Dive (10/31/21)

Talkspace is Transforming the Landscape in Behavioral Health

Talkspace is an online mental health therapy company that recently completed its SPAC merger with Hudson Investment Executive in June. Talkspace has been a major beneficiary in the paradigm shift for behavioral therapy, which has shifted mostly to online consultations thanks to the pandemic. Online therapy has had several advantages over traditional therapy including the privacy and convenience, which could means that the medium is likely to stay in the long run, even as the pandemic ends.

While Talkspace continues to benefit from the secular tailwinds of the industry, the stock continues to get hammered as the company has been accused of unethical data mining practices and fake App Store reviews. Valuations have plummeted over 45% this quarter, but there may be some light at the end of the tunnel.

Sponsored this week by…

Want to find more Digital Health Companies? Try Benzinga

(Offer Expires 11-01-2021)

I use tons of trading software to help me better understand the market and make smarter trading decisions. One thing I love about Benzinga Pro is its versatility. It wasn’t built for just one type of trader but for a wide range of experienced investors like myself. I can create custom watchlists, and then quickly monitor the performance of my investments.

Some great news - Benzinga is giving all subspac readers a free two week trial!

Addressing a Growing Need in Behavioural Health

Behavioral Health is a vital service with an enormous addressable market both in the United States and abroad. Over 70 Million Americans suffer from a wide variety of mental illnesses, but the pandemic has only accelerated this phenomenon. Experts estimate that over 60% of adults reported that their mental health had deteriorated due to the pandemic lockdowns, with the prevalence of depression symptoms growing over 3x since last March. Suicide continues to be one of the top 10 leading causes of death in the US, with more than 48,000 Americans dying of suicide annually.

Companies like Talkspace are vital to combat the next wave of suicides led by depression and will play a large role in the general mental well-being of consumers world-wide. For those unfamiliar, Talkspace is a leading virtual behavioral health company that offers convenient and affordable access to a network of qualified providers. TALK provides members access to licensed mental health providers across a wide and growing spectrum of care through virtual counseling, psychotherapy and psychiatry. The company’s platform aims to address the vast, unmet and growing demand for mental health services for its members. In addition to its individual customers, TALK works with enterprise clients such as Google and Accenture and employee assistance programs such as Aetna, Cigna, Premera, Humana and Optum who offer their employees access to the company’s platform at reimbursement rates.

How does Talkspace Differ from Traditional Therapy?

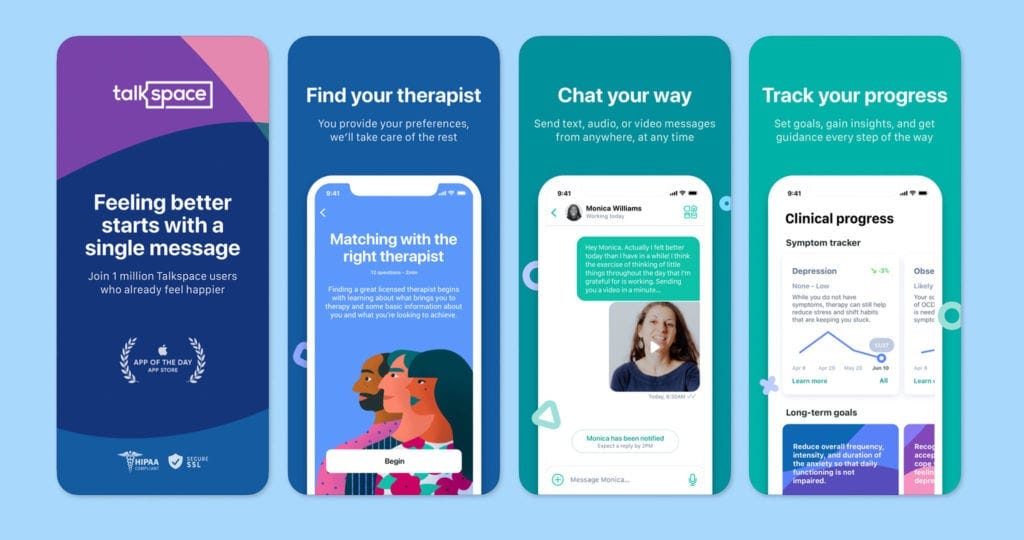

Talkspace aims to differentiate itself in behavioral health as it uses its proprietary technology platform to deliver personalized care at lower costs. This is evident with the company’s statistics, where 98% of its members see the platform as more effective and convenient than traditional therapy. The process starts with the company’s proprietary matching algorithm, which aims to match users with providers to suit their specific needs. Much like a matchmaking service for dating, there are several options presented to users ranging from a number of licensed, accredited and experienced therapists. Providers are verified through a background check and are required to have over 3000 plus hours of clinical experience, which ensures that a high standard is maintained across the board.

After matching users with providers, the company’s machine learning-driven tools enable meaningful clinical outcomes with a higher rate of success. TALK also tracks outcomes and user engagement to improve the feedback thereby providing better care through iterations. Finally, the company has a unique clinical progress tracker, which enables data-driven discharge results and reinforces the positive next step for users. The whole process is built with user privacy in mind, with the highest encryption standards in the industry.

Multiple Avenues for Continued Rapid Growth

The company expects to penetrate the University market to reach a new target base. Once the company captures a sizeable market share in the US, it expects to target other customs in English speaking markets, with primary target markets including Australia, Canada, New Zealand, South Africa and the UK. TALK believes that there are over 30 million customers with a potential global behavioral health market of $215 Billion. TALK also plans to grow inorganically through potential M&A opportunities across the behavioral health landscape. A good example of this is the company’s acquisition of Lasting, which enabled higher Average Revenue Per User (ARPU) by upselling products, addressing price-sensitive users enabling the expansion of its member base.

Financials and Valuation

Talkspace generates revenues from the sale of monthly membership subscriptions to its therapy platforms, payments from consumers and annually contracted platform access fees paid by enterprise clients. TALK has seen rapid revenue growth over the last few years, with annual revenues climbing from $18 Million in 2017 to $76 Million in 2020 at a CAGR of 62%. This growth is expected to prevail in the near term, both through newer B2B and B2C Clients and strong engagement within the existing client base. The company reported an EBITDA loss of $22 Million in 2020, driven by costs to acquire new clients through the form of discounts and rebates. TALK expects to be EBITDA positive as it shifts its product mix towards higher-demanded video therapy plans for B2C customers and higher ARPU B2B clients. Over time, the company’s platform should present operational automation opportunities, which should significantly reduce overhead costs and improve operating margins.

Talkspace merged with SPAC Hudson Executive Investment at a valuation of $1.4 billion earlier this year, but shares have been trading at a significant discount since. While TALK started trading at $9, a significant selloff in the stock means that the stock is currently trading at $3.44 and boasts a market capitalization of just $523 million. The primary reasons for a selloff in the stock can be attributed to privacy concerns as a former employee spoke to the New York Times about certain data mining practices within the company, as well as App Store review inflation. TALK continues to deny the allegations claiming that it is a privacy-first platform but this may have permanently damaged the reputation of the company for some users. Despite the criticism levied against the company, the risk seems to be factored into the current stock price.

Bottom Line

TALK currently has over 62,000 members. It expects to expand this by utilizing its brand awareness & member engagement through various social channels and celebrity partnerships with the likes of Michael Phelps and Demi Lovato. A study conducted recently shows that the global behavioral and mental health software market is expected to grow at a CAGR to be 19.6% from 2021 to 2027, reaching a market of $6 Billion by 2027, ensuring that there is plenty of room for growth. One area where TALK has room to grow is in the B2B segment where it has seen over 20x growth in the last two years. The company anticipates that it can further accelerate this growth through outbound marketing and leverage its existing consultant relationships to reach additional clients which should result in a higher valuation in the coming years.

Trick or treat edition 🎃

trading at $HOFV levels bad