Flipping The Switch

The Rundown - Your weekly SPAC Deep Dive (11/05/23)

Happy Sunday Friends!

The industrial landscape is currently at a crossroads. With current power grids showing their age, industries are grappling with issues like inconsistent service, fluctuating costs, and the growing need for electrification, due to global decarbonization targets. Industrial Power solutions firm One Power is looking to take advantage of the market trend by delivering scalable, eco-friendly, and reliable power solutions. With a diverse set of offerings and commitments from major customers, One Power is positioning itself as a leader in the growing industry. But while the narrative is promising, can One Power truly deliver on its promises?

Power Struggles

Industrial electricity demand in the US presents a unique set of challenges. The sheer magnitude of industrial operations, coupled with the aggressive net-zero targets set by companies worldwide, outlines the complexity of this issue. To put it in perspective, a recent report highlighted that while the 53,000 industrial facilities in the US account for a mere 0.6% of total users, they are responsible for a staggering 26% of consumption. This translates to an annual electricity sales figure of $58 billion.

However, the industrial utility market is plagued with challenges. Industries routinely face utility failures, and the unpredictability of electricity prices has been a sore point, with some customers witnessing price hikes ranging from 30-60%, between 2021 and 2022. The push to decarbonize industries is intensifying, driven by both economic imperatives and societal expectations. However, there's a looming risk that the commitments to clean power might remain on paper and not translate into tangible action.

Many industry experts are skeptical about the longevity of the current centralized power grid, especially given the impending pressures of electrification. Transitioning from fuel-based to electric processes is no small feat, especially for expansive power distribution systems. The existing industrial high-voltage power systems seem ill-equipped to manage this shift.

The current landscape provides opportunities for solutions like Expandable Microgrids, On-Site Renewables, and advanced High-Voltage Power Systems. One Power, an Ohio-based industrial power solutions firm, is stepping up with its Utility 2.0 grid, which is positioned as a more straightforward solution for industrial clients, One Power promises on-site power resources that not only reduce carbon emissions but also guarantee fixed rates for two decades, simplify systems, and ensure reliable power services.

Want to Find the Best De-SPACs? Try Benzinga

(Offer Expires 11-15-2023)

I use tons of trading software to help me better understand the market and make smarter trading decisions. One thing I love about Benzinga Pro is its versatility. It wasn’t built for just one type of trader but for a wide range of experienced investors like myself. I can create custom watchlists, and then quickly monitor the performance of my investments.

Some great news - Benzinga is giving all subspac readers a free two week trial!

Winds of Change

Established in 2009, One Power is a vertically integrated industrial power solutions provider. The company's forte revolves around the development, construction, ownership, and operation of advanced, behind-the-meter power solutions, notably in wind energy, tailored for the industrial sector.

One Power's Utility 2.0 represents a shift towards a decentralized, customer-centric power grid, which the company says empowers industrial clients to generate their own on-site, renewable energy. By building, owning, and operating significant electrical infrastructure for these industrial users behind the meter, One Power can deliver enhanced utility monitoring, clarity on long-term rates, and heightened reliability of utility services.

One Power boasts a suite of solutions. This includes "Wind for Industry”, which provides on-site, behind-the-meter wind energy with megawatt-scale turbines, anchored by 20-year fixed-rate contracts. The "Managed High Voltage" solution offers digital, high-voltage power infrastructure on-site, allowing clients to connect at elevated voltages, distribute power more efficiently, and further electrify their operations.

"Megawatt Hubs" are sites interconnected at transmission voltage, ranging between 30MW to 150MW, primed for the energy-intensive industries of tomorrow, such as mobile data centers and commercial electric vehicle fleets. Lastly, their "Net Zero Projects" amalgamate wind, solar, and power infrastructure, propelling industries closer to their annual net-zero grid energy usage goals through on-site renewable generation.

One Power has also secured long-term binding contracts, spanning up to 20 years, with industry giants like Whirlpool, Marathon Petroleum Corporation, Holcim, Ball Corporation, and Martin Marietta.

Financials and Valuation

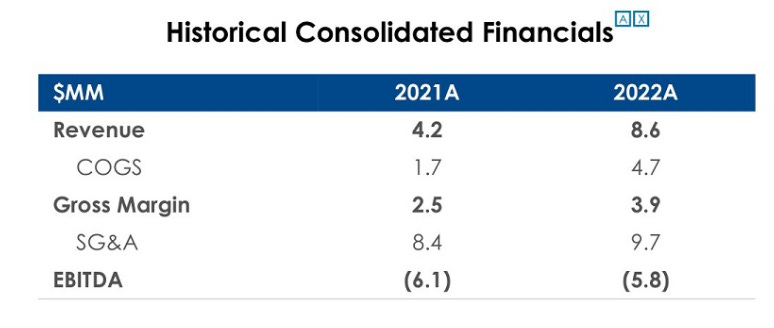

The SPAC Deal values One Firm at an enterprise value of $300 million. This deal is anticipated to generate gross proceeds of up to $345 million, which will be used to bolster growth and supplement working capital. Looking at the company’s recent financials, it generated revenues of $4.2 million in 2021 and $8.2 million in 2022. Against these revenues, the company generated an EBITDA loss of $6.1 million and $5.8 million respectively.

This implies that the company will trade at close to 15x forward revenues, even assuming that One Power will double revenues in 2023 and 2024, as it did between 2022 and 2021.

All of this isn’t considering that the company doesn’t anticipate being profitable for the next few years, especially given the company’s high upfront capital expenditure costs.

However, it’s important to consider that the company has several 20-year long-term contracts with customers, implying that revenues will scale over time, and the company will eventually reach breakeven. The company said that it currently had $514 million in contracted revenue, which would imply $337 million in contracted operating profit. Based on these metrics, and the rapidly growing addressable markets due to the requirements, the company could eventually catch up to its valuation.

Bottom Line

Industrial power solutions, One Power, is positioning itself to be at the forefront of a rapidly evolving sector. The challenges of high upfront costs and near-term profitability concerns are counterbalanced by the vast addressable market and the pressing need for reliable, sustainable power solutions. As industries globally grapple with electrification and decarbonization, One Power's offerings could be pivotal.