AST SpaceMobile vs Starlink: The Race for Global Connectivity

The Rundown - Your weekly SPAC Deep Dive (08/28/22)

Happy Sunday, Friends!

Elon Musk's Starlink recently announced plans to enter the global carrier market, spooking shareholders of space-based cellular operator AST SpaceMobile. AST, which went public through a SPAC in 2021, has plans to commercialise global space based telecommunications, but has notably struggled due to technical challenges.

AST Shareholders have feared that the Starlink announcement risked overshadowing the company’s upcoming launch and also possibly beat the company to market, despite the latter having a significant head start. So how does AST stack up against Starlink's tech, and can it dominate the space-based cellular market?

The Space-Based Cellular Market

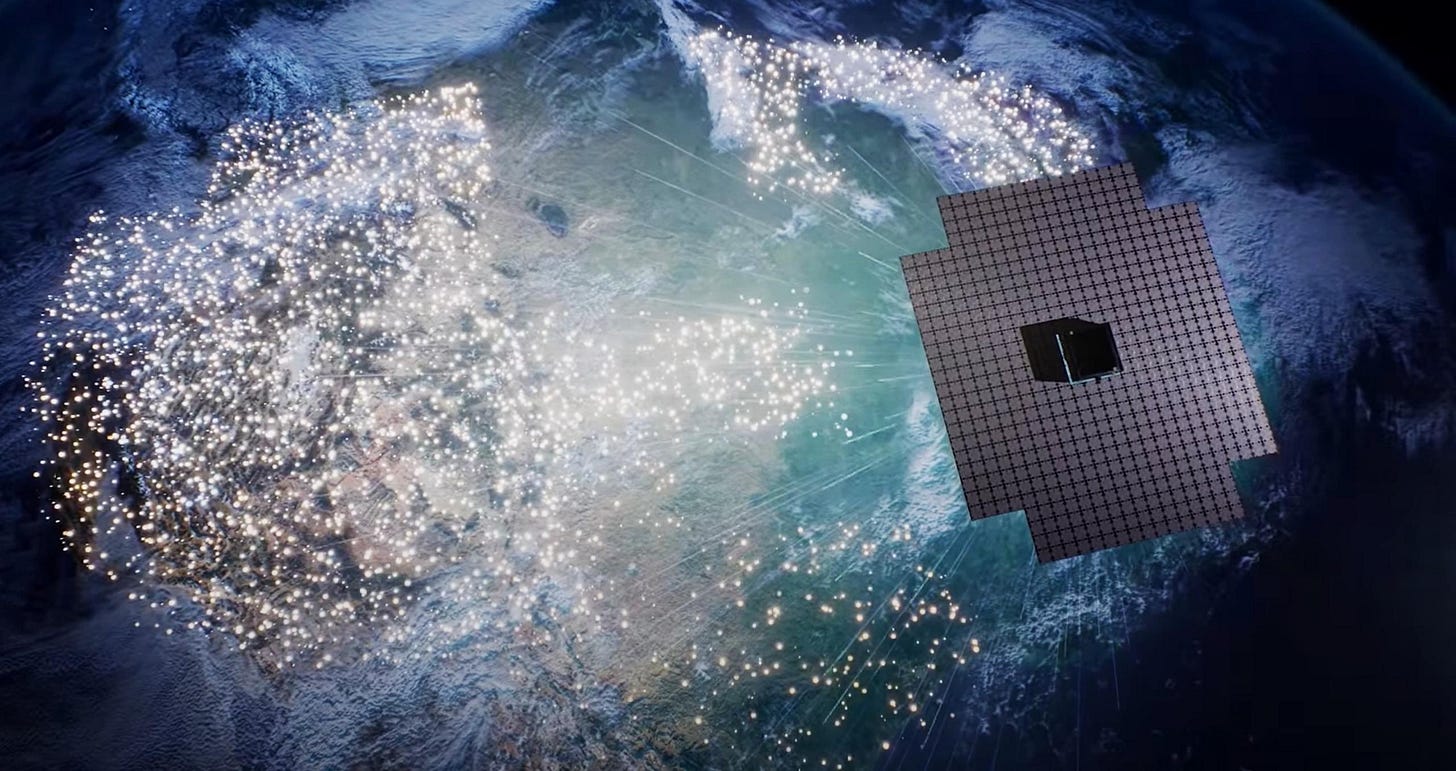

First, let's quickly recap AST's ambitions and its history so far. Founded in 2017, the Midland, Texas-based company is building a constellation of satellites designed to deliver broadband and cellular service from space to consumer smartphones. AST aims to eliminate dead zones and areas with limited cellular coverage, which in itself could represent a large chunk of the $1.1 trillion global mobile wireless services market.

The company wants to make the carrier experience seamless, unlocking additional value for subscribers while reducing subscriber churn (from customers who would have previously changed carriers due to frustrations with existing coverage). However, not everything has gone according to plan for AST since announcing its plans for global cellular domination.

AST successfully went public through a SPAC merger in April 2021, but a string of developmental and operational delays have put the company on the back foot. After initially announcing launch plans for its test satellite named Bluewalker 3, AST has delayed plans until September 2022.

Furthermore, supply chain constraints and inflation has hit the company, which resulted in AST pushing back its commercial plans and the launch of its Bluebird satellites for another six months. The company had previously planned to deploy 110 satellites to achieve global mobile coverage by 2024 but has now focused on building and launching its first 25 satellites by the end of 2023.

Sponsored this week by…

Want to Find the best Space Stocks? Try Benzinga

(Offer Expires 09-02-2022)

I use tons of trading software to help me better understand the market and make smarter trading decisions. One thing I love about Benzinga Pro is its versatility. It wasn’t built for just one type of trader but for a wide range of experienced investors like myself. I can create custom watchlists, and then quickly monitor the performance of my investments.

Some great news - Benzinga is giving all subspac readers a free two week trial!

Starlink’s Entry Into the Market

AST's stumbles have enabled other competitors to take the lead. Just this week, SpaceX announced a partnership with T-Mobile to launch its own satellite carrier service, with a potential commercial rollout by the end of next year. SpaceX claimed that the next generation Starlink satellites (version 2.0), which are expected to launch next year, will communicate directly with phones, letting users text, make calls and use select apps even when there are no cell towers nearby. Starlink's satellites are expected to roll out the service on T-mobile's mid-band PCS spectrum.

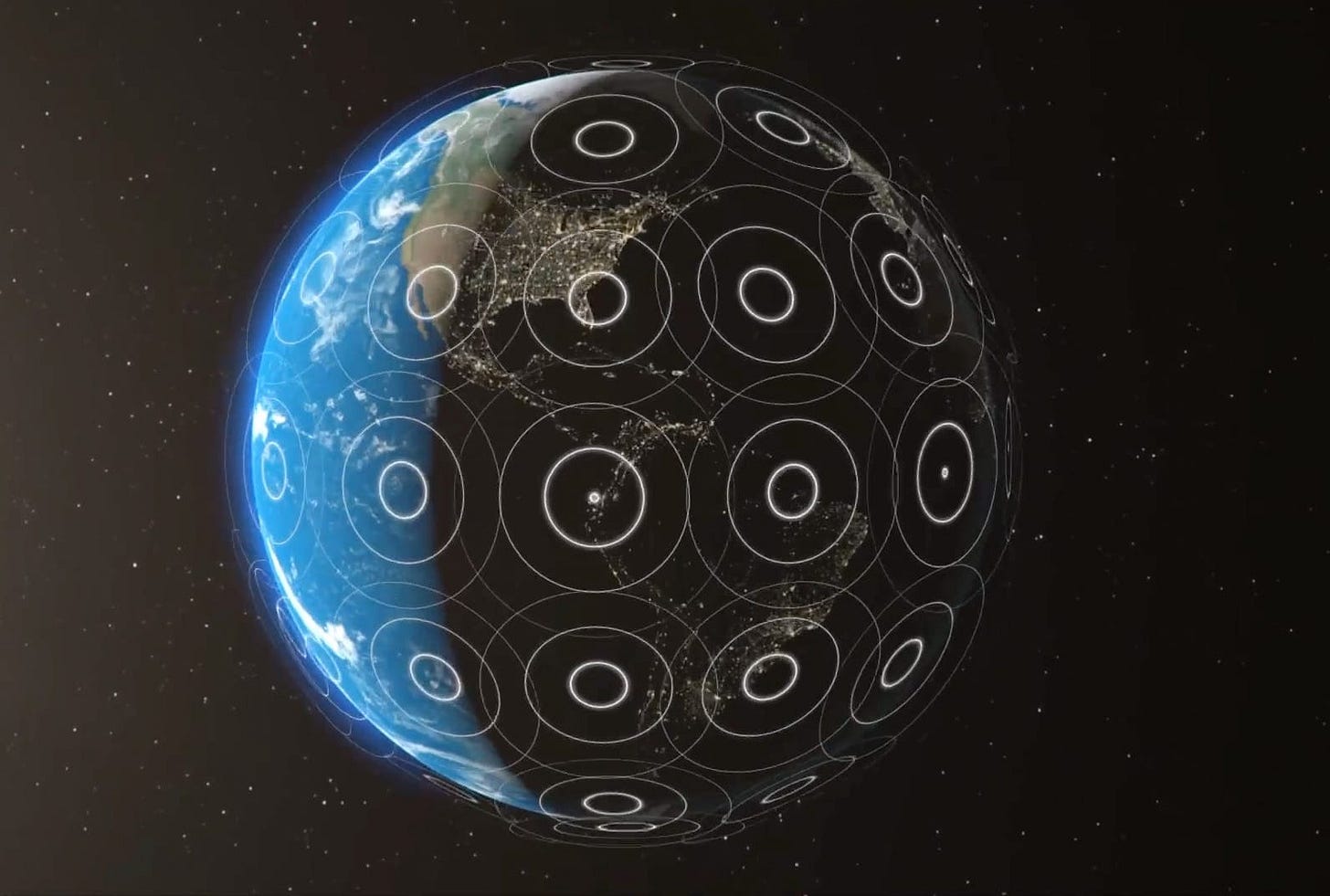

SpaceX said that the T-mobile partnership could work without access to the company's full constellation as it would use the intermittent connection for basic coverage. This would enable customers to use a slice of the connection, resulting in speeds of between 2 and 4 mb/s. Starlink's solution is also expected to work with existing cellphones (similar to AST), which will likely lead to higher adoption as soon as it is deployed. There's good reason to be bullish about Starlink's capabilities and future carrier partnerships.

The company managed to launch over 2,000 satellites between 2018-22 and has the launch capabilities to deploy its next-generation satellites for less than its competitors (which is why AST plans to launch its satellites on SpaceX flights as well). Furthermore, the company's next-generation launch vehicle, dubbed 'Starship' is the largest rocket built to date, significantly increasing the number of satellites that can be carried on a single flight (up to 400 version 1.0 satellites), thereby reducing the time and costs required to deploy the fleet.

Commercial Viability

AST Saw its stock sink on the day of the Starlink - T-Mobile announcement but erased its losses on the day of the partnership announcement. While SpaceX's entry into the industry can seem daunting for AST at first sight, in many ways, the company's entry is a boost for AST. SpaceX's entry into the cellular satellite market validates the business plan for AST SpaceMobile, while also drawing plenty of attention from carriers who may have not previously focused on investing in space-based solutions.

While T-Mobile plans to deliver data a few years after its initial deployment, AST plans to roll out 4G and 5G networks for cell phones. The company believes that betting that the idea of broadband will be more appealing than just being able to text and make calls from remote areas. Another area where AST is miles ahead is in its commercial rollout. The company has a wide range of commercial agreements and has signed various Memorandum of Understanding (MOUs) since 2019, greatly enhancing its coverage area and potential customers.

AST has executed commercial agreements with Vodafone (610 million subscribers) and AT&T (171 million subscribers) for deployment across the US and Africa. Furthermore, the company has also signed MOUs with Telefonica (344 million subscribers), Orange (220 million subscribers), Globe Telecom (87.4 million subscribers), and many others for potential partnerships across Europe and Asia. The total potential customers for AST now stand at 1.8 billion subscribers, dwarfing Starlink's 110 million potential subscribers from the T-Mobile announcement.

SpaceX executives have expressed interest in partnering with other mobile carriers worldwide in spectrum sharing agreements so that their customers would link up with SpaceX, but time will tell how the company can drum up interest. The partnerships also give AST a key technical advantage over SpaceX's solution. Since both solutions rely on carriers for spectrum sharing, AST is a truly global solution, enabling customers who travel worldwide to have access to cellular solutions based on agreements with carriers in the countries.

Bottom Line

Shareholders of AST were worried about SpaceX's entry into the satellite carrier market and capitalizing on the company's various delays. However, SpaceX's entry into the market validates AST's business model and shows how far the latter is compared to the former. AST has the commercial partnerships and business side of things locked in place to scale rapidly after launching next year, but the only area of concern is the company's ability to solve its technical issues. After several delays due to challenges with production, AST is finally gearing up for a test next month, with a potential commercial rollout to follow later. If the company can execute in key areas, it could blitz the market and outpace its rivals, but if it continues to stumble, it could see companies like SpaceX enter the market and take a slice of the market share.